Post Contents

What is Bad Credit in UK?

What is bad credit in the UK? Being on bad credit in the UK means that you have a history of not being able to pay your bills on time. This could be due to a lack of money, being unemployed, or having problems with debt. If you have bad credit, it may be difficult to get loans or credit cards, and you may have to pay higher interest rates on loans.

You may also find it harder to get employment because lenders may be reluctant to give you a loan if they think you won’t be able to repay it. There are a number of ways to improve your credit score if you have bad credit. You can try to pay off your debt as quickly as possible, make sure you keep up with your payments and avoid taking out too many loans at once. If you need help improving your credit score, there are a number of agencies that can help.

Why You Should Get a Bad Credit Credit Card?

There are a number of good reasons why you should consider getting a bad credit credit card. Firstly, it can act as a temporary measure to help you get back on track with your finances. Secondly, it could provide you with the much-needed boost to start rebuilding your credit rating. Finally, if used responsibly and with caution, a bad credit credit card can also be an excellent way to build up your savings.

Here are four more reasons why you should get a bad credit credit card:

1. It Can Help You Manage Your finances If you have bad credit, getting a bad credit card can help you manage your finances in a number of ways. For example, using the card as part of a budgeting strategy can help keep track of how much money is being spent and where it’s going. Additionally, using the card to reduce borrowing costs could lead to greater financial stability down the line.

2. It Can Provide You With Momentum Toward Rebuilding Your Credit Rating If used responsibly and with caution, a bad credit credit card can help rebuild your credit rating in a short period of time. By using the cards for small purchases and paying off the balance each month, you’re putting yourself in a good position to improve your score over time. In some cases, however, not paying off the debt could actually lead to negative consequences such as higher interest rates or reduced access to critical loans in the future.

3. A Bad Credit Card Can Help You Build Up Your Savings A bad credit credit card can help you build up your savings by providing access to high-interest rates and promotional offers. By spending wisely and using the card sparingly, you could quickly accumulate a sizable savings account.

4. It Can Be an Excellent Way to Improve Your Credit Score If used responsibly, a bad credit credit card can be an excellent way to improve your credit score. By using the card responsibly and paying off the balance each month, you’re putting yourself in a good position to improve your score over time. Additionally, by using the card sparingly, you could avoid high interest rates and other fees that can hurt your credit rating.

Best Credit Cards for Bad Credit in UK

1. Amazon Classic Mastercard

If you have a poor credit history, the Amazon Classic Mastercard may be the perfect card for you. This card offers low interest rates and no annual fees, which makes it a great choice if you need to rebuild your credit score.

If you have a poor credit history, the Amazon Classic Mastercard may be the perfect card for you. This card offers low interest rates and no annual fees, which makes it a great choice if you need to rebuild your credit score.

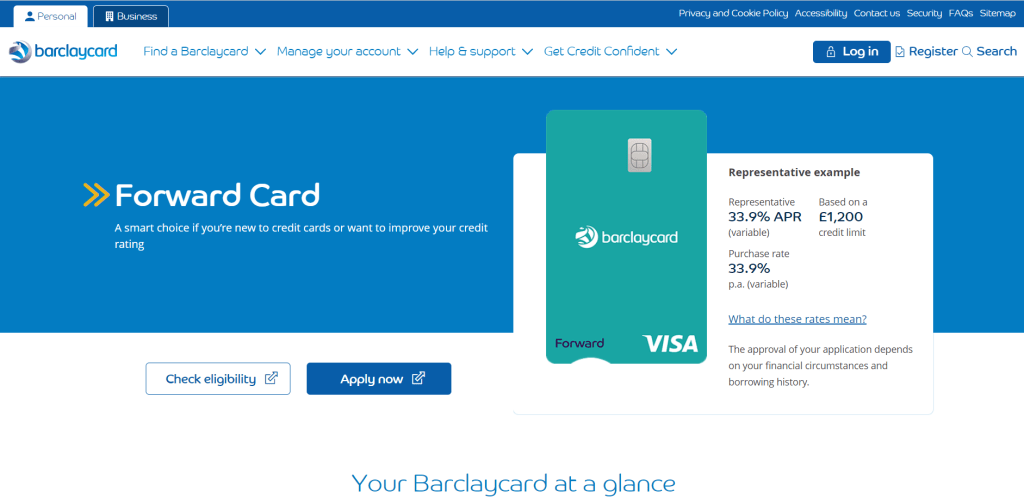

2. Barclaycard Forward Card

If you have a poor credit history, the Amazon Classic Mastercard may be the perfect card for you. This card offers low interest rates and no annual fees, which makes it a great choice if you need to rebuild your credit score.

If you have a poor credit history, the Amazon Classic Mastercard may be the perfect card for you. This card offers low interest rates and no annual fees, which makes it a great choice if you need to rebuild your credit score.

If you have a poor credit history, the Amazon Classic Mastercard may be the perfect card for you. This card offers low interest rates and no annual fees, which makes it a great choice if you need to rebuild your credit score.

3. Tesco Foundation Credit Card

If you have a poor credit history, the Amazon Classic Mastercard may be the perfect card for you. This card offers low interest rates and no annual fees, which makes it a great choice if you need to rebuild your credit score.

If you have a poor credit history, the Amazon Classic Mastercard may be the perfect card for you. This card offers low interest rates and no annual fees, which makes it a great choice if you need to rebuild your credit score.

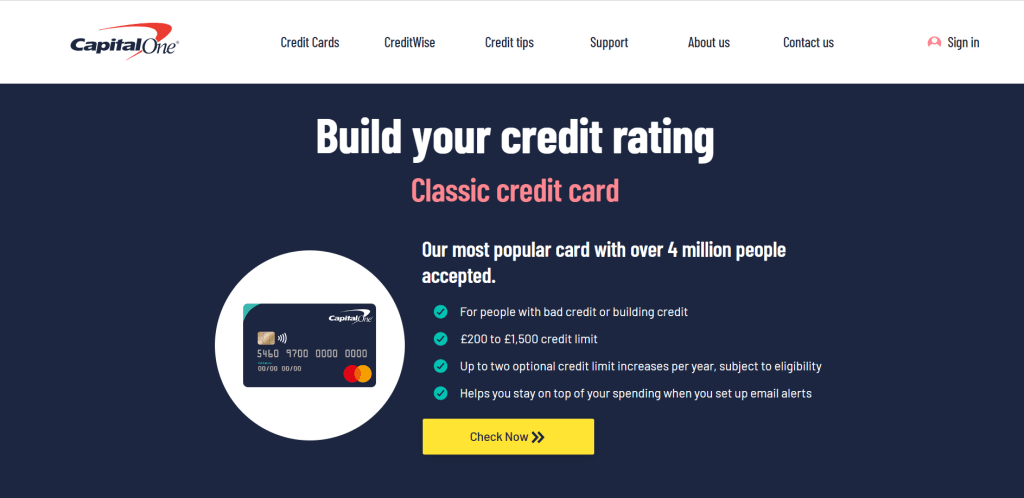

4. Capital One Classic Credit Card

If you have a poor credit history, the Amazon Classic Mastercard may be the perfect card for you. This card offers low interest rates and no annual fees, which makes it a great choice if you need to rebuild your credit score.

If you have a poor credit history, you may want to consider the Capital One Classic Credit Card. This card offers great benefits, like 0% intro APR for 12 months and no annual fee. You can use this card in any card reader.

5. Vanquis Bank Chrome Credit Card

If you have a poor credit history, the Amazon Classic Mastercard may be the perfect card for you. This card offers low interest rates and no annual fees, which makes it a great choice if you need to rebuild your credit score.

Plus, there are no annual fees or late fees, so you can keep your expenses under control. And if your credit score isn’t as great as you’d like it to be, don’t worry – the card issuer offers a 0% introductory APR offer for 12 months. So if you’re looking for a reliable option that won’t break the bank, the Vanquis Bank Chrome Credit Card is definitely worth considering.

6. HSBC Classic Credit Card

If you have a poor credit history, the Amazon Classic Mastercard may be the perfect card for you. This card offers low interest rates and no annual fees, which makes it a great choice if you need to rebuild your credit score.

This card also has several benefits for people with bad credit. For example, it offers a 0% APR introductory period on purchases and balance transfers. Plus, if you make your monthly payments on time, your account will be eligible for a 0% APR for up to 12 months. Finally, this card comes with fraud protection and an extended warranty.

7. Tesco Bank Foundation Credit Card

If you have a poor credit history, the Amazon Classic Mastercard may be the perfect card for you. This card offers low interest rates and no annual fees, which makes it a great choice if you need to rebuild your credit score.

The card also has a buy now, pay later feature that allows you to borrow money up to 25% of your purchase value and defer payments over 6 months. Additionally, this card has an emergency cash assistance feature that provides up to £500 when you need it most. If you are looking for a good credit card that won’t require a lot of commitment from you, the Tesco Bank Foundation Credit Card might be a good choice.

8. Barclaycard (branch) Better Together Credit Card

If you have a poor credit history, you may want to consider the Barclays Better Together Credit Card. This card offers a range of benefits and features that can help improve your score.

For example, the card has an 0% introductory APR on purchases and the best balance transfers for the first 12 months. Additionally, you can get up to £500 in cashback each year, and there are no annual fees. If you need help improving your credit score, the Barclays Better Together Credit Card can help make it easier to get approved for loans and other types of credit products.

9.Aquis credit card

If you have a poor credit history, you may want to consider the Barclays Better Together Credit Card. This card offers a range of benefits and features that can help improve your score.

If you have a poor credit history, you may want to consider the Barclays Better Together Credit Card. This card offers a range of benefits and features that can help improve your score.

10. Nutmeg Visa Credit Card from Barclaycard

If you have a poor credit history, you may want to consider the Barclays Better Together Credit Card. This card offers a range of benefits and features that can help improve your score.

Here are some of the reasons why it’s a good choice for bad credit: -The interest rates are low, starting at 9.99% APR. -You can get up to £2,500 in bonus cash when you spend £1,000 within the first three months.

There is no annual fee. -You can also use the card to purchase items online and in stores. Overall, this is a great card for those looking to improve their credit score. If you’re considering applying for a card with bad credit, be sure to consider the Nutmeg Visa Credit Card from Barclaycard.

11. Nationwide Building Society Credit Card

If you have a poor credit history, you may want to consider the Barclays Better Together Credit Card. This card offers a range of benefits and features that can help improve your score.

If you have a poor credit history, you may want to consider the Barclays Better Together Credit Card. This card offers a range of benefits and features that can help improve your score.

12. Virgin Money Credit Card

If you have bad credit, Virgin Money may be the best card for you. The Virgin Money Credit Card offers a low interest rate and no annual fees. You can also get cashback and bonuses on spending.

Once you have been approved, your Virgin Money Credit Card will arrive in the mail. The card has an annual fee of £0 (which is waived the first year), but there are no other fees or charges associated with using it. Virgin Money offers a low credit card interest rate of 9.99% APR (variable).

This means that you’ll be able to save money on your payments each month, which can help reduce your overall debt burden over time. In addition to this low-interest rate, the Virgin Money Credit Card also offers a number of benefits that could make it a valuable option for someone with bad credit.

These include:

1. A 0% introductory APR for 18 months*, meaning that you’ll start off with zero payments on purchases made with your card – this is great if you’re just getting started building your credit history and want to avoid highinterest rates in the future.

2. A cashback bonus of up to £150 every year when you spend £500 or more on eligible purchases with your card; – No annual fees, which means that you’ll be able to keep more of your money every month.

3. Automatic credit monitoring, so you can stay up to date on your credit score and know if there are any changes that may affect your borrowing capacity.

4. 24/7 customer support. If you’re looking for a card with low interest rates and no annual fees, the Virgin Money Credit Card could be a good option for you. In addition, the card offers several benefits that could make it an even more valuable tool in your financial arsenal. If you have bad credit, the Virgin Money Credit Card may be the perfect choice for you.

Conclusion

It can be hard to get approved for a credit card, no matter how good your credit score is. That’s why it’s important to take the time to research which cards are best suited for you based on your unique circumstances. In this article, we have compiled some of the best cards available for people with bad credit in the UK. Apply now and see if you can improve your financial situation!