Post Contents

Categories

Subscribe to Updates

Get the latest news from Online Business Blog.

Get the latest news from Online Business Blog.

Post Contents

Choosing the most acceptable small business bank account is a great way to make your company’s money go further and your life simpler. Changing their small company’s current performance may not be at the top of most owners’ priority lists. However, when monthly fees, transaction expenses, integrated accounting software, automated invoicing, and foreign charges are all considered, doing so may make a significant difference to your bottom line. Continue reading our guide on the top 10 the best small business bank accounts in the UK.

Starling Bank is a challenger bank that has made waves and transformed the economic environment in the United Kingdom. It is Europe’s fastest-growing bank, with a 3% market share.

This bank, founded by Anne Boden, has streamlined all personal and corporate banking aspects.

A Starling business account is a terrific place to start for any firm, but since their service is straightforward, accessible, and scalable, you’ll be hard-pressed to find a reason to quit.

Sign up for an account via their app, accessible for iOS and Android. Excellent customer assistance provides via in-app chatting.

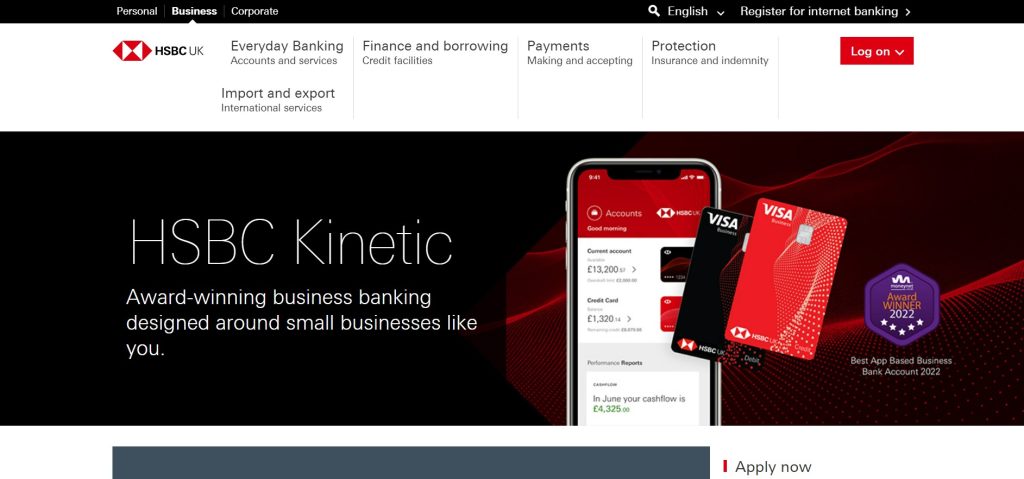

Customers may get 12 months of free banking with HSBC’s Kinetic account starting on June 1st, meaning no maintenance fees or ordinary account costs throughout the free banking term.

Customers may also apply for an overdraft of up to £30,000, with cash accessible when the application is approved. They will only pay interest on the amount of money they utilize.

With the number of startups projected to increase in the UK, new firms are turning to the banking sector for new and creative banking solutions. This service is provided by ANNA, an online or mobile bank.

It takes a no-fuss, no-nonsense approach to banking, making it the perfect online bank for anyone looking for simplicity.

This account is presently only available to existing Santander clients wishing to create new business current accounts, but the bank claims it is still reviewing the situation.

Customers with no more than two directors, proprietors, or partners in their first year of business may qualify for 18 months of free banking if it is their company’s first business current account with Santander. The report may maintain at Santander cash machines and Post Office offices around the country and online and mobile banking.

Tide, like other banks, provides three options to corporate clients for them to expand their accounts as they develop. There are three types of accounts: basic, Tide Plus, and Tide Premium.

It implies stepwise alternatives for a startup to establish with the bank as your firm finances become more sophisticated.

The most basic Tide account, pay-as-you-go, allows for several cards, which is excellent if you want your squad to be able to pay for stuff. You may also establish up to 5 additional accounts, which helps conserve or ring-fencing money when necessary.

The account provides 18 months of free banking for businesses in their first year of operation with an anticipated or actual annual revenue of less than £1 million.

It includes payments made into or out of your current account by direct debit, standing order, debit card, internet banking, or ATM withdrawals. Customers will also get free access to the accounting software Free Agent, which will allow them to manage cash flow, invoices, and record costs.

Customers may also apply for NatWest’s corporate credit card, subject to approval, and avoid paying the £30 annual charge in the first year, with the price waived beginning in the second year if they spend £6000 or more per year.

The Yorkshire Bank is a high street bank that ranks fourth on our ranking of startup bank account providers. There are several benefits to adopting this bank for a starting account, including its free 25 months of banking for new business clients.

However, if you need a responsive app or digital access to your account, this may not be your account. Customer service is good, and they are working to strengthen their internet presence.

Startups and smaller enterprises with an annual sales or balance sheet worth less than £3 million are eligible for the Lloyds business account for new and small businesses.

It includes payments made into or out of your current account by direct debit, standing order, debit card, internet banking, or ATM withdrawals. Due to overwhelming demand, it informs consumers that new business accounts may take four weeks to establish.

NatWest, a Royal Bank of Scotland affiliate, is one of the Big Four high street banks and, as one would expect, provides a wide range of business account options. Mettle is their response to the internet and mobile banking challenge.

Revolut Business, which debuted in 2019, claims to enable startups and small companies to expand as necessary while still giving them control over their funds, both online and in-app.

Revolut, another challenger bank making headlines for all the right reasons, provides a superb account for entrepreneurs. It includes all standard functions, and its charges are comparable to those of its major online banking competitors.

Where it differs is in the efficient and safe transfer of several currencies. It accepts payments from your checkout page using WooCommerce, Magento 2.0, and PrestaShop plugins. If you are a startup with international ambitions, this may be the bank account. There is just one word of caution: the costs you will be charged if you exceed the boundaries of your price plan.

Startup owners have an endless list of chores, and picking which bank account to create is sometimes forgotten. During the first several months, you’ll need an account that allows you to spend using a corporate card or bank transfer while allowing for convenient record-keeping for financial reporting. What about reports with additional functionality? Are they worth it in the beginning? These different technologies, such as invoicing management and payroll administration, may help you grow. Don’t know which business bank account is appropriate for startups? Don’t worry. Our above guide on best bank accounts for small businesses in UK got you covered.