Post Contents

If you have bad credit, you may think that getting a loan for your business is out of the question. But the truth is, there are plenty of options available to you – you just need to know where to look. In this blog post, we will explore some of the best ways to get loans for businesses with bad credit. From government initiatives to working with alternative lenders, we will cover all the bases so that you can get the funding you need to get your business off the ground.

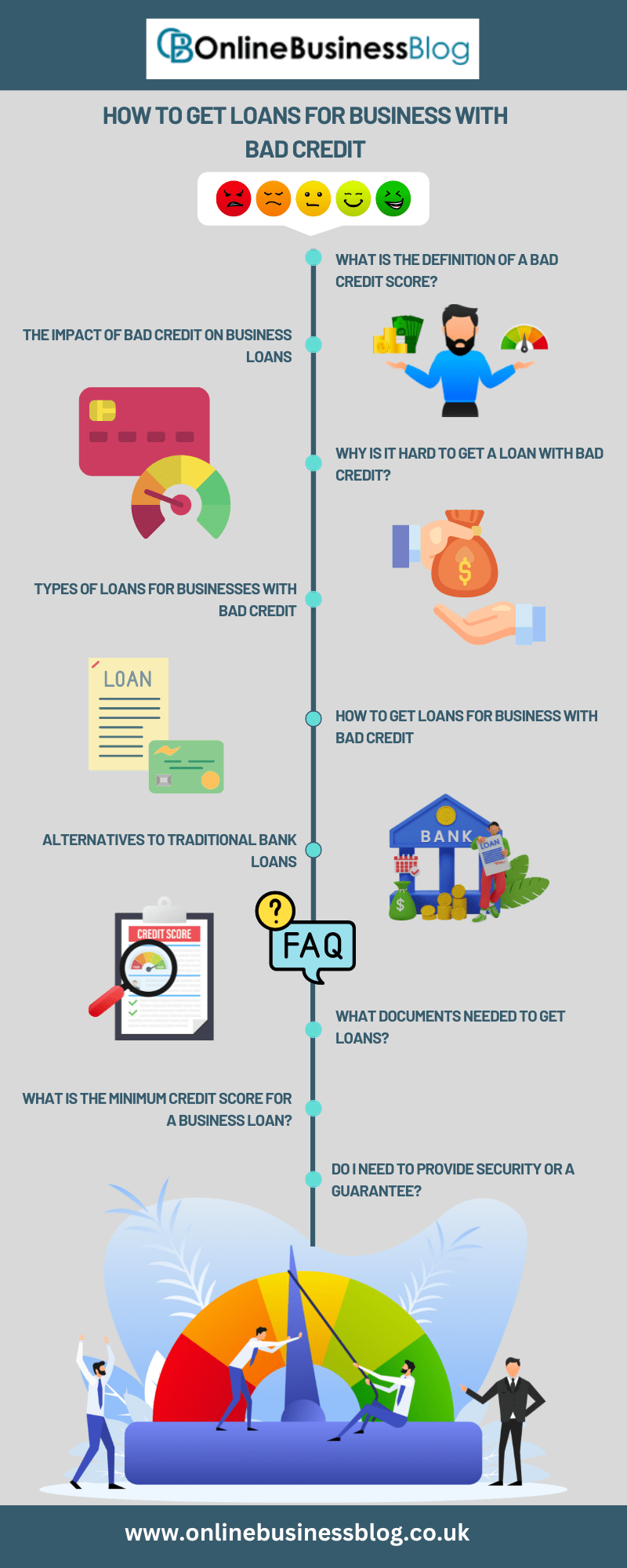

What is the definition of a bad credit score?

A bad credit score is a numerical expression of your creditworthiness. It is based on your debts, payment history, and other factors. A bad credit score can make it difficult to get loans for business.

The FICO score is the most popular kind of credit score. The better your score, the higher your credit. A score of 700 or above is considered good, while a score below 600 is considered bad.

There are a number of ways to improve your credit score, including paying your bills on time, maintaining a good debt-to-income ratio, and using a mix of different types of credit. If you have bad credit, loan options are still available. You may need to provide collateral or agree to a higher interest rate.

The Impact of Bad Credit on Business Loans

Bad credit can significantly impact your ability to obtain financing for your business. Lenders will often view businesses with bad credit as being high-risk, and as a result, may be less likely to extend loans or lines of credit. In some cases, you may only be able to qualify for higher interest rates and less favorable loan terms. Additionally, bad credit can limit your borrowing options and make it more difficult to obtain funding in the future.

If you are struggling with bad credit, there are still options available to help finance your business protection. You may be able to find lenders who are willing to work with you or look into alternative financing options such as grants or crowdfunding. Taking steps to improve your credit score can also make it easier to get approved for loans in the future.

Why is it hard to get a loan with bad credit?

There are a number of reasons why it can be difficult to get a loan with bad credit. For one, lenders may view you as a high-risk borrower and be unwilling to take on the risk of lending to you. Additionally, if you have bad credit, you may not qualify for traditional loans from banks or other financial institutions.

Another reason why it can be hard to get a loan with bad credit is that your options may be limited. Lenders who are willing to work with borrowers with bad credit typically charge higher interest rates and fees. This means that the overall cost of the loan will be higher, making it more difficult to repay.

Steps to Take If You Have Bad Credit

If you have bad credit, there are a few steps you can take to get loans for your business:

1. Raise your credit score personally – If you have bad credit, you should start with this. This is possible if you use a credit monitoring service, pay your bills on time, and keep a good credit score.

2. Find a co-signatory – You might be able to find a cosigner for your loan if you are unable to raise poor credit scores on your own. A cosigner is someone who consents to cosign the loan with you and is liable for the payments in the event that you are unable to make them.

3. Find a lender that specializes in bad credit loans – There are some lenders that specialize in providing loans to businesses with bad credit. These lenders may be more willing to work with you and offer lower interest rates than traditional lenders.

4. Offer collateral – When you apply for a loan, you may be able to increase your chances of approval by offering collateral, such as property or equipment, to secure the loan.

5. Use alternative financing options – If traditional loans are not an option for you due to your bad credit, there are other financing options available, such as merchant cash advances or short-term loans.

Tips on Managing Your Personal Finances

If you have bad credit, getting a loan for your business can be difficult. However, there are some things you can do to improve your chances of getting approved. First, make sure to put together a strong business plan. This will show lenders that you are serious about your business and that you have a solid idea of how you will use the loan.

Next, try to find a co-signer who has good credit and is willing to sign on to the loan with you. This will help improve your chances of getting approved, as lenders will see that someone with good credit is vouching for you. Finally, be prepared to offer collateral for the loan. This could be in the form of property or equipment, and it will show lenders that you are willing to put something up as security for the loan.

Types of Loans for Businesses With Bad Credit

There are a few different types of loans available for businesses with bad credit. The most common type of loan is called an unsecured business loan. This type of loan does not require any collateral, which makes it a good option for businesses that do not have any assets to use as collateral. Unsecured business loans can be used for a variety of purposes, including working capital, expanding your business, or even refinancing existing debt.

Another type of loan available for businesses with bad credit is called a secured business loan. This type of loan requires collateral, such as property or equipment, in order to secure the loan. Secured business loans are often easier to qualify for than unsecured loans, but the downside is that if you default on the loan, you could lose your collateral.

Finally, there are also government-backed loans available for businesses with bad credit. These loans are backed by the Small Business Administration (SBA) and typically have more favorable terms than other types of loans. However, they can be difficult to qualify for and usually require a strong business plan and financials.

How to Get Loans for Business with Bad Credit

There are a number of ways to get loans for businesses with bad credit. The most common way is to go through a bank or credit union. There are also a number of online lenders that cater to businesses with bad credit.

The first step is to compare rates from different lenders. Be sure to read the terms and conditions carefully before signing any loan agreement.

Once you have found a lender, if you are comfortable with them, the immediate step is to fill out an application. Be sure to include all pertinent information about your business ideas, such as financial statements and tax returns.

If you are approved for a loan, the lender will likely require collateral, such as property or equipment. This gives them something to seize if you default on the loan.

As with any loan, be sure to make timely payments and pay off the balance as soon as possible. Doing so will help improve your credit score and make it easier to get loans in the future.

Alternatives to Traditional Bank Loans

There are many alternatives to traditional bank loans for businesses with bad credit.

Here are a few:

1. Small Business Administration (SBA) Loans: SBA loans are backed by the U.S. government and can be a great option for businesses with bad credit.

2. Equipment Financing: If you need to purchase equipment for your business, you may be able to finance it through a third-party lender.

3. Invoice Financing: This type of financing allows you to use your outstanding invoices as collateral for a loan.

4. Peer-to-Peer (P2P) Lending: P2P lending platforms connect borrowers with investors who are willing to fund their loans.

5. Angel Investors: If you can find an angel investor or venture capital firm that’s willing to invest in your business, they may give you the funds you need without requiring collateral or a personal guarantee.

FAQ

What Documents Needed to Get Loans?

If you have bad credit, there are still options for getting loans for your business. However, you will need to provide some additional documentation in order to qualify.

First, you will need to provide proof of your income and your ability to repay the loan. This can be in the form of tax returns, pay stubs, or bank account statements.

Next, you will need to provide collateral for the loan.

Lastly, you may need to provide a personal guarantee for the loan. This means that you will be responsible for repaying the loan even if your business fails.

If you have bad credit, it is still possible to get loans for your business. However, you will need to provide some additional documentation in order to qualify.

What is the minimum credit score for a business loan?

Bad credit can make it difficult to get a loan for your business. The good news is, there are lenders out there who are willing to work with you, even if your credit score isn’t perfect.

The minimum credit score for a business loan will vary from lender to lender. However, a small business loan’s average minimum credit score is 620. Keep in mind that this is just the average minimum – some lenders may have a higher minimum credit score requirement.

If your credit score is lower than 620, do not despair – there are still options available to you. A few lenders may work with you even if your credit score is as low as 580. Others may require a higher minimum, such as 650 or 680.

No matter what your credit score is, there are steps you can take to improve it. If you have time before you need to apply for a loan, focus on paying down any outstanding debts and making all of your payments on time. These positive actions will help improve your credit score over time.

Do I need to provide security or a guarantee?

If you have bad credit, you may still be able to get a loan for your business. However, you will likely need to provide security or a guarantee in order to qualify.

Security or a guarantee is an asset that can be used to secure the loan. The most common form of security is collateral, which is something of value that can be sold if you default on the loan. Collateral can include real estate, vehicles, equipment, inventory, or other valuable property.

Guarantees are another way to secure a loan. With a guarantee, someone else agrees to repay the loan if you default. This could be a family member, friend, or business partner. The guarantor must have good credit and adequate income to qualify.

Providing security or a guarantee can help you get approved for a loan with bad credit. It shows the lender that you are willing to take responsibility for the debt and that there is someone else who can repay the loan if you can’t.

Conclusion

There are a few options available for business owners with bad credit who need to take out a loan. The best course of action is to work on rebuilding your credit score so that you can qualify for better terms in the future. In the meantime, consider using a cosigner or applying for a secured loan to get the funding you need. With some patience and perseverance, you can eventually get your business back on track financially.