Post Contents

A balance transfer credit card is a type of credit card that allows you to transfer your existing credit card balance to a new credit card with a lower interest rate. This can save you money on interest payments and help you pay off your debt faster. There are a few things to consider when choosing a balance transfer credit card, such as the length of the intro APR period, the balance transfer fee, and the ongoing APR. In this blog post, we will discuss everything you need to know about balance transfer credit cards, including how they work and the best offers available.

What Are Balance Transfer Credit Cards?

Balance transfer credit cards are a type of credit card that allows cardholders to transfer high-interest debt from one or more other credit cards to the balance transfer card. This can help cardholders save money on interest and pay off their debt faster. In order to qualify for a balance transfer, cardholders typically need to have good or excellent credit.

There are a few things to keep in mind when you consider a balance transfer credit card. First, many balance transfer cards come with an introductory 0% APR offer, but after that expires, the APR will usually increase to a higher rate. Second, balance transfers usually come with a fee of 3-5%, so it’s important to do the math to make sure you’ll still save money in the long run. Finally, make sure you pay off your transferred balance before the intro period expires, or you’ll be stuck paying interest on the entire amount.

If you’re looking to save money on interest and pay off your debt faster, a balance transfer credit card could be a good option for you. Just make sure you want to understand the terms and conditions before you apply.

How do balance transfer credit cards work?

Balance transfer credit cards work by transferring the balance of one credit card to another credit card. This can be done either by transferring the entire balance or by transferring a portion of the balance. The new credit card will then have a lower interest rate, which will save you money on interest payments.

The benefits of balance transfer credit cards

Balance transfer credit cards can be a great way to save money on interest and pay down debt. When you transfer a balance from one credit card to another, you can often take advantage of a lower interest rate for a specified period of time. This can helps you to save money on interest and pay off your debt faster.

There are a few things you want to keep in mind when considering a balance transfer credit card. And know how many credit cards should I have. First, make sure you understand the terms and conditions of the balance transfer offer. Some offers may have a balance transfer fee or require that you maintain a minimum balance on the new card.

Second, remember that transferring a balance will not eliminate your debt; it will simply move it to another bank account. You will still need to make payments on the new account and pay off the balance before the end of the promotional period to avoid incurring additional interest charges.

If you are struggling with high-interest debt, a balance transfer credit card could be a good option for you. Just be sure to do your research and understand the terms and conditions of any offer before you apply.

The drawbacks of balance transfer credit cards

Balance transfer credit cards can be a great way to save money on interest and pay down debt, but there are some potential drawbacks to consider before you sign up for one.

First, balance transfer cards typically have a much higher interest rate than regular credit cards. This means that if you carry a balance on your balance transfer card, you could end up paying a lot of interest.

Second, balance transfer cards often come with fees. These fees can range from 3% to 5% of the amount you transfer, so be sure to read the fine print before you sign up.

Third, balance transfers can take a few weeks to process, so if you need to make a purchase right away, you might not be able to use your balance transfer card.

Finally, if you’re not careful, you could end up in more debt than you were in before you got the balance transfer card. If you’re transferring a balance from one high-interest credit card to another, you’re not really getting ahead. And if you start using your balance transfer card for new purchases, you could find yourself in even more debt than before.

So while balance transfer credit cards can be helpful in paying down debt and saving on interest, there are some potential drawbacks to consider before you sign up for one.

How to compare balance transfer credit cards?

There are a few things to consider when you compare balance transfer credit cards. The first is the intro APR. This is the introductory rate that you’ll get on your balance transfers. It’s important to compare this because it can save you a lot of money in the long run.

The second thing to consider is the balance transfer fee. Some cards will charge a fee for balance transfers, so it’s important to compare this as well. Finally, you’ll want to consider the ongoing APR. You’ll be charged this interest rate after the intro period ends. Again, it’s important to compare this because it can save you money in the long run.

How to use a balance transfer credit card?

If you are looking to your debt consolidation, a balance transfer credit card may be a good option for you. With a balance transfer credit card, you can transfer the balance of your other credit cards to the new card, which will usually have a lower interest rate. This can helps you to save money on interest and pay off your debt faster.

When choosing a balance transfer credit card, it is important to compare the interest rates and fees of different cards. Some cards may offer 0% interest for a promotional period, but then charge high fees for the balance transfer. Make sure you understand the terms and conditions of the card before you apply.

Once you have been approved for a balance transfer credit card, you can begin transferring your balances. To do this, simply call your other creditors and ask them to send a balance transfer check to the new card. You will need to provide them with the account number and routing number of the new card. Once the balances have been transferred, make sure to keep up with your payments on the new card to avoid incurring more debt.

How to Apply for a Balance Transfer Card?

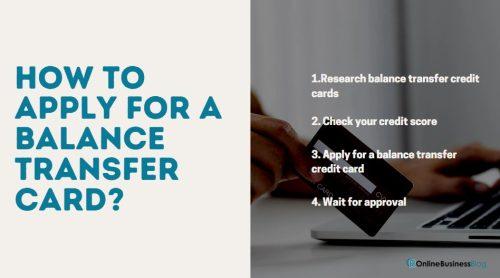

If you’re looking to consolidate your debt or save on interest, a balance transfer credit card could be a good option for you. Here’s how to apply for one:

1. Research balance transfer credit cards – Look for cards that offer 0% interest on balance transfers for an introductory period of time. Also compare fees, annual percentage rates (APRs), and other features to find the best deal.

2. Check your credit score – You’ll need good to excellent credit (a score of 660+) to qualify for the best balance transfer offers.

3. Apply for a balance transfer credit card – Once you’ve found the right card, fill out an application online or over the phone. Be sure to have your most recent statements handy so you can provide accurate information about your current debt situation.

4. Wait for approval – If your application is approved, you’ll receive your new card in the mail within a few weeks. Once it arrives, activate it and start transferring your balances from other cards onto your new 0% APR balance transfer card.

How can you tell if a balance transfer card is fair or not?

When you are looking for a balance transfer credit card, it is important to make sure that you find one that is fair. There are a few things that you can look for to make sure that the card is fair.

First, you will want to check the credit card interest rate. The interest rate should be low enough that you will be able to save money by transferring your balance. If the interest rate is too high, it may not be worth it to transfer your balance.

Second, you will want to check the fees associated with the card. Some cards will charge a fee for balance transfers, while others do not. You will want to make sure that the fees are reasonable before you transfer your balance.

Third, you will want to check the terms and conditions of the card. This includes things like the length of time you have to pay off your balance, and any penalties for late payments. You will want to make sure that these terms are fair before you transfer your balance.

Fourth, you will want to check the rewards program associated with the card. Some cards offer cash back or other rewards for using their card. If this is important to you, then you will want to make sure that the card offers the best rewards credit card program.

Finally, you will want to read reviews of the card before you apply. This can help you see what other people think about the card and if there have been any problems with it in the past.

Tips on How to Use Your New Balance Transfer Credit Card Most Responsibly

Assuming you recently applied for and were approved for a balance transfer credit card, congrats! This is a great way to save money on interest and get your debt averaged down to a manageable level. But before you start swiping that plastic, here are a few tips on how to use your new balance transfer credit card most responsibly:

1. Make sure you have a plan in place – Before transferring any balances, sit down and map out a plan. Determine how much you can realistically afford to pay each month, and make sure the terms of your balance transfer align with that plan.

2. Automate your payments – Once you have a plan in place, automate your payments so you never forget to take payment. This will help keep you on track and avoid accruing any additional interest or fees.

3. Pay more than the minimum payment – When it comes to paying off debt, paying more than the minimum payment is always ideal. By doing this, you’ll reduce your overall debt faster and save money in the long run.

4. Avoid using your credit card for new purchases – Once you’ve transferred your balances over to your new balance transfer credit card, avoid using it for any new purchases. Instead, focus on using it solely for the purpose of paying off debt. If you must use it for new purchases, be sure to pay off that debt as quickly as possible so you don’t end up carrying multiple balances on your card.

5. Keep an eye on your credit utilization – One crucial factor that impacts your credit score is your credit utilization ratio. It’s important to keep this ratio low, so monitor it closely and make payments accordingly.

By following these tips, you can use your new balance transfer credit card most responsibly and get one step closer to becoming debt-free!

The Best Balance Transfer Cards to Apply for in 2022

There are a few things you want to consider when looking for the best balance transfer credit card. The first is the interest rate. You’ll want to find a card with a low-interest rate so you can save money on interest charges. The second is the balance transfer fee.

Some cards charge a fee for balance transfers, so you’ll want to find a card with a low or no balance transfer fee. The third is the length of the intro period. The intro period is the amount of time you have to pay off your balance before interest charges kick in. You’ll want to find a card with a long intro period so you can take your time paying off your debt.

The fourth factor to consider is the credit limit. Some balance transfer credit cards come with high credit limits, which can be helpful if you have a lot of debt to pay off. However, high credit limits can also lead to more debt if you’re not careful. Finally, you’ll want to consider any rewards or perks that come with the card.

Some balance transfer credit cards offer rewards like cash back or points, which can be helpful if you use your card responsibly and pay off your balance in full each month.

Now that you know what to look for in a balance transfer credit card, here are some of the best options available in 2022:

The Citi Simplicity Card offers 0% APR on balance transfers for 18 months, and there is no balance transfer fee. This makes it an excellent option if you need to transfer a balance from another card with a high-interest rate.

The Citi Simplicity Card also offers 0% APR on purchases for 18 months, so it can be a good choice if you’re planning on making a large purchase and need some time to pay it off. There is no annual fee for this card.

The Chase Slate Card offers 0% APR on balance transfers and purchases for 15 months, and there is no balance transfer fee for transfers made within 60 days of account opening.

This makes it an excellent choice if you need to transfer a balance from another card with a high-interest rate. The Chase Slate Card also offers a $0 annual fee, so it’s a good choice if you’re looking for a card with no annual fee.

The Discover it® Balance Transfer Card offers 0% APR on balance transfers and purchases for 18 months, and there is no balance transfer fee for transfers made within the first 60 days of account opening. This makes it an excellent choice if you need to transfer a balance from another card with a high-interest rate.

The Discover it® Balance Transfer Card also offers 5% cash back on rotating categories each quarter, up to $1,500 in spend per quarter, and there is no annual fee for this card.

The Amex EveryDay® Credit Card from American Express offers 0% APR on balance transfers and purchases for 15 months, and there is no balance transfer fee for transfers made within the first 60 days of account opening.

This makes it an excellent choice if you need to transfer a balance from another card with a high-interest rate. The Amex EveryDay® Credit Card from American Express also offers 2x points at US supermarkets, on up to $6,000 per year in spending, and there is no annual fee for this card.

Conclusion

Balance transfer credit cards can be a great way to save money on interest and pay down your debt faster. However, it’s important to understand how do credit cards work before you sign up for one. Make sure you know the details of the offer, including the intro APR period, balance transfer fee, and any other terms and conditions. Once you’ve found the right card for you, follow our tips to make the most of your balance transfer and get out of debt as quickly as possible.